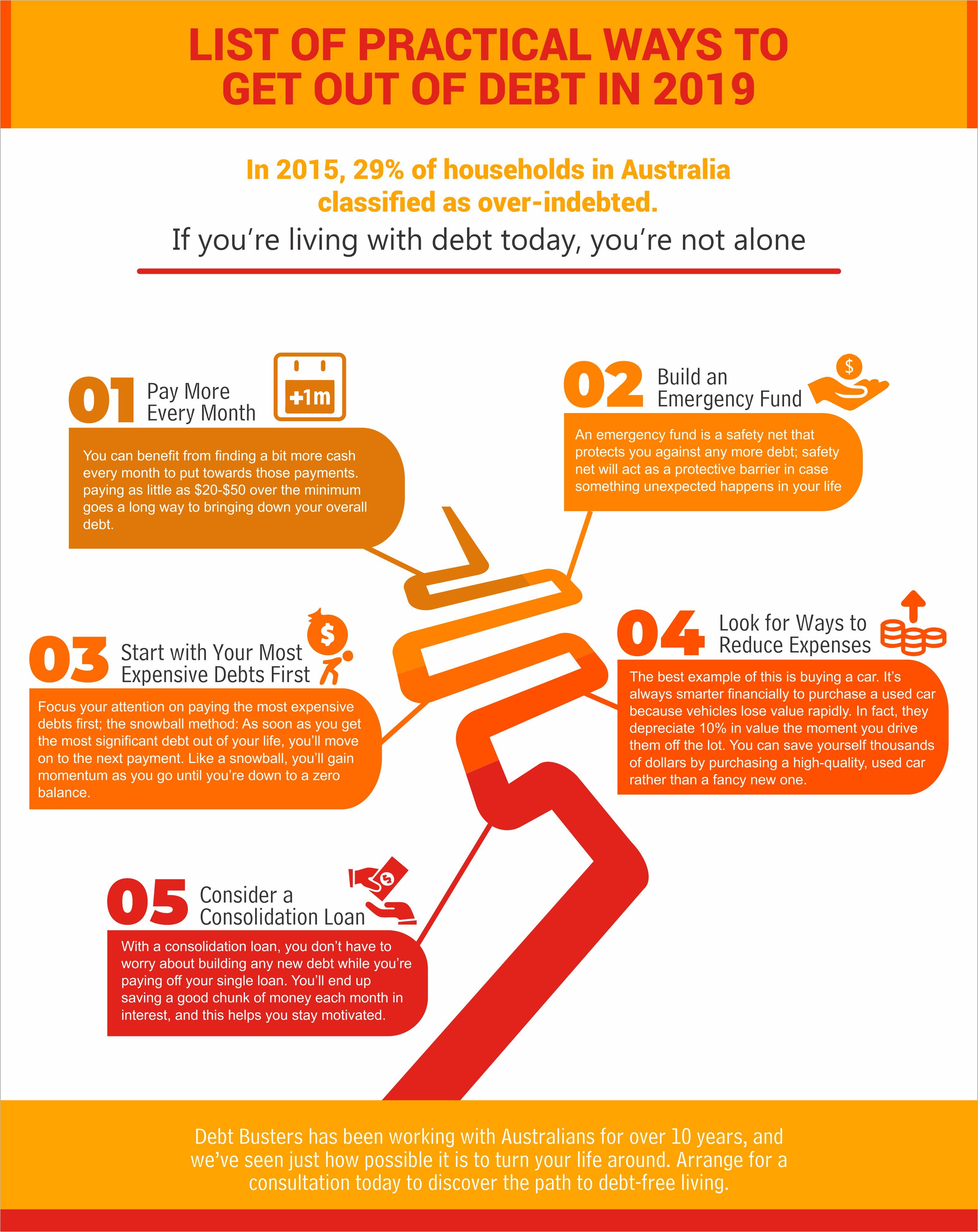

If you’re living with debt today, you’re not alone. In 2015, 29% of households in Australia classified as over-indebted. Luckily, all you need is the right strategy to start working to get rid of debt and start a new life today.

Like most financial decisions, there is no “right way” to eliminate debt. The most important step to get rid of debt once and for all is simply to get started.

This list of practical ways to get out of debt in 2019 will let you finally free your finances. The hardest part is just making that first payment. Before you know it, you’ll be living happily debt-free!

1. Pay More Every Month

The first step is to make larger payments each month towards your debt. Whether you have personal loans, credit cards, or a mortgage, you can benefit from finding a bit more cash every month to put towards those payments.

These bills all have a minimum payment you need to make every month to stay on top of your balance. Thanks to high-interest rates, this means your debt will only create more debt if you keep to the minimum payments.

However, that doesn’t mean you need to pay an excessive amount over that minimum every month. On the contrary, just paying as little as $20-$50 over the minimum goes a long way to bringing down your overall debt.

2. Build an Emergency Fund

An emergency fund is a safety net that protects you against any more debt. It’s easy to turn to credit cards and loans if you’re stuck with an unexpected payment or financial catastrophe, but that will only result in even more debt.

The only way to get rid of debt for good is to create an emergency fund. These savings are set aside for things like home repairs, medical emergencies, and unemployment. With an emergency fund, you don’t have to worry about what will happen if you lose your job tomorrow or if your car breaks down.

An emergency fund is a way to break up with borrowing for good. You know you don’t want to get into any more debt, so this safety net will act as a protective barrier in case something unexpected happens in your life.

3. Start with Your Most Expensive Debts First

When you’re making payments towards all of your debts at once, you struggle to stay on top of everything. You don’t need to place that much pressure on yourself. In fact, these spread out minimum payments might not bring you any closer to success.

Instead, focus your attention on paying the most expensive debts first. This is the one that will cost you the most money the longer it takes to pay, so you should dedicate the largest payment to this and only this. Continue making minimum payments (or a little over!) on the remaining debts until you get that big one down.

This process has a name: the Snowball Method. Think of it like a snowball. As soon as you get the most significant debt out of your life, you’ll move on to the next payment. Like a snowball, you’ll gain momentum as you go until you’re down to a zero balance.

This is scientifically proven to work in your favor. According to a study from the Journal of Marketing Research, the Snowball Method has motivational benefits. As you make more small victories, you’re empowered to keep going forward with your goals.

4. Look for Ways to Reduce Expenses

Take a close look at your spending over the month. We all want to have the latest-and-greatest tech, cars, and fancy things, but these might be costing us money we don’t have.

The best example of this is buying a car. It’s always smarter financially to purchase a used car because vehicles lose value rapidly. In fact, they depreciate 10% in value the moment you drive them off the lot. You can save yourself thousands of dollars by purchasing a high-quality, used car rather than a fancy new one.

Another way to reduce expenses is to look at how you’re spending money every month. For many people, a chunk of the monthly budget goes towards eating out or expensive trips. Consider cutting these costs by looking for grocery deals in your neighborhood, or by skipping that cross-country holiday.

You might be surprised how much you enjoy cooking at home or how much fun it can be to explore your own backyard. Remember, expensive doesn’t mean better. Plus, this newfound savings helps you get rid of debt for good. That’s something we all feel confident about.

5. Consider a Consolidation Loan

Loan consolidation is a great way to combine all of your current debts into a single one with a lowered interest rate. While this isn’t available for all types of debts, it’s worth considering if you’re currently paying many consumer debts like credit cards.

With a consolidation loan, you don’t have to worry about building any new debt while you’re paying off your single loan. You’ll end up saving a good chunk of money each month in interest, and this helps you stay motivated.

The key to making a consolidation loan work for your finances is to commit to a savings plan. You need savings-focused spending habits to make the most of this repayment option. You’ll have that balance down to zero in no time!

Get Rid of Debt for Good

Managing to get rid of debt is easier than you think as long as you’re willing to make these essential changes to your financial habits. From building an emergency fund to consolidation options, you’re only a few steps away from a life without debt.

DebtBusters has been working with Australians for over 15 years, and we’ve seen just how possible it is to turn your life around. Arrange for a consultation today to discover the path to debt-free living.

Fill in the contact form below to arrange a consultation or call us on 1300 368 322 for more information! Your success is just a few clicks away!